About the Founder and Editor

Julian Gresser is an international attorney, professional negotiator, inventor, and recognized expert on East Asia, and CEO of Big Heart Technologies, a humanitarian Benefit Corporation founded to provide tools and resources to empower collaborative innovation and negotiation training.

As a negotiator his most dramatic success involved helping a San Francisco-based trading company transform its $8 million after-tax branch into a $1 billion Japanese company in seven years. He has served as legal advisor to numerous U.S., Japanese, and European companies on a wide array of business issues, including joint ventures, limited (venture capital) partnerships, technology licensing, export controls and customs fraud, antitrust, and intellectual property protection, particularly patent infringement disputes. Julian Gresser has been twice Visiting Mitsubishi Professor of Japanese law at the Harvard Law School and a visiting professor at MIT, Doshisha University (Kyoto) and the Beijing University. He has been a senior consultant to the U.S. State Department, The World Bank, The Prime Minister’s Office of Japan, The People’s Republic of China, and the European Commission (where he trained the Commission’s Japanese negotiating teams).

Julian Gresser is the author of four books, Environmental Law in Japan (MIT Press, 1981), Partners in Prosperity: Strategic Industries for the U.S. and Japan (McGraw Hill, 1984; in Japanese, Cho Hanei Sengen), and Piloting Through Chaos: Wise Leadership/Effective Negotiation for the 21st Century (Five Rings Press, 1996), (in Japanese, Ishi Kettei Isutsu no Hosoku–Koshodo no Gokui, Tokuma Shoten Publishing Company, Tokyo, 1997), and Piloting Through Chaos—The Explorer’s Mind (English publication: August 2013, Bridge 21 Publications), in addition to numerous articles in English and Japanese on technology, economics and law.

Julian Gresser is the innovator of a 21st humanitarian/business model embodied in the work of Neurogenics and Alliances for Discovery. The model is described in two recent articles “Beyond Shared Value—Character as Corporate Destiny” ; and in a visionary piece published in July 2016, “Seeing the Big Picture in Medical Science”. Julian Gresser’s latest book, Laughing Heart™–A Field Guide to Exuberant Vitality for All Ages will be published in March 2017.

Julian Gresser Precedents and Precursors in Developing “The Resilient Negotiator”

- 1971–Japan Center for Human Environmental Problems—After the Stockholm Conference for the Environment of 1971 JG conceived the idea of a public interest law center in Japan, linked to environmental action groups around the world. He was invited to Japan by the presidents of Tokyo and Hitotsubashi Universities who supported his negotiations in establishing a Japan Center for Human Environmental Problems which was active for the next ~35 years.

- 1975–1981 Visiting Professorships at Harvard Law School and MIT. During this period JG taught at Harvard and MIT and wrote his treatise on Environmental Law in Japan (Gresser, Fujikura, Morishima, MIT Press 1981). The course introduced various innovative systems of dealing with risk assessment and administrative compensation which are directly applicable today in addressing the challenges of 5g Installations. The Japanese system of Compensating Victims of Pollution described in Environmental Law in Japan is the direct legal precursor of the Super-Fund legislation in the U.S. which stemmed directly from JG’s course at Harvard Law School.

- 1976–1977 Palau SuperPort—While teaching environmental law at Harvard Law School, JG was approached by various major environmental organizations to assist in the Palau SuperPort case, which involved a transshipment facility that would have devastated Palau’s fragile coral reef system. JG conceived the idea of bringing a petition before the Japanese Diet, advocating caution and a review of the project. Representing a coalition of environmental organizations, JG duly presented this Petition (in Japanese). Forewarned, he was confronted by the legal argument that foreigners had no Petition Rights in Japan. JG debated this proposition on prime-time television, pointing out that the Diet’s position violated Japan’s own Petition Law and the U.S.-Japan Treaty on Friendship and Commerce. The Japanese government subsequently announced its abandoning of the project. JG was recognized as the “man of the day” by the Asahi News. (the Petition is available in full in Environmental Law in Japan (MIT Press, 1981)

- 1981 Japan Industrial Policy Group (JIPG). While serving as Richard Holbrooke’s (then U.S. Assistant Secretary of State) adviser on Japan, JG conceived and chaired the Japan Industrial Policy Group in the State Department which engaged representatives from eight Congressional Committees and every major concerned U.S. government agency. Working closely with the presidents of Intel, Texas Instruments, and other major semiconductor companies, the JIPG produced the first collaborative industrial policy for the electronics industry which set a precedent for many other approaches to strategic industries in the U.S. and abroad. The work of the JIPG became the basis for a two-year course at Harvard Law School and MIT and a book, Partners in Prosperity—Strategic Industries for the U.S. and Japan (McGraw Hill 1984). The Report of the JPIG authored by JG was published as “High Technology and Japanese Industrial Policy (House Ways and Means Committee 1981)

- 1985 Venture Capital in Japan. JG conceived the idea of bringing U.S. venture capital into Japan and assisted one of the major East Coast venture capital companies (Palmer) in building effective strategic alliances in Japan.

- 1987 European Commission. JG acted as a principal adviser to the European Commission in preparing its negotiating teams to manage their negotiations with the Japanese government. JG also trained over 100 Swedish companies through a program sponsored by IFL, the leading management school in Sweden.

- 1995 Getz Bros. Japan—JG conceived the idea of taking foreign companies public on the Japanese stock market. His most celebrated case involved the $ 8 million after tax Japanese branch of Getz Bros. a San Francisco based trading company specializing in heart valves and pace makers and other cardiovascular products. In collaboration with his client, Professor James E. Schrager, the team negotiated an ongoing engagement with the leading Japanese venture capital companies and succeed in listing Getz. Bros Japan on the Japanese Over the Counter Market, with a valuation of $ 1.2 billion seven years later. The case was later described in an article in the Wall Street Journal, “Going Public Japanese Style” which was later recognized as one of the top articles in the Manager’s Journal.

- 2000 Japanese Nuclear Transshipment. Representing the Rainbow Serpent Coalition, JG conceived the idea of bringing an administrative law suit to compel attention in Japan on the environmental risks of nuclear waste transshipment, which caused reconsideration of this policy.

- 2011—2014 Fukushima. JG prepared a letter in Japanese to the Japanese Prime Minister and Emperor’s Household on how to manage the clean up after the Fukushima nuclear accident and also offering a way to anticipate and plan for future earthquakes. JG’s sources inform him that this activity supported by about ten other articles had a beneficial influence in creating greater public awareness of Japanese government policies. http://www.explorerswheel.com/blog/how-secure-are-spent-fuel-pools-fukushima

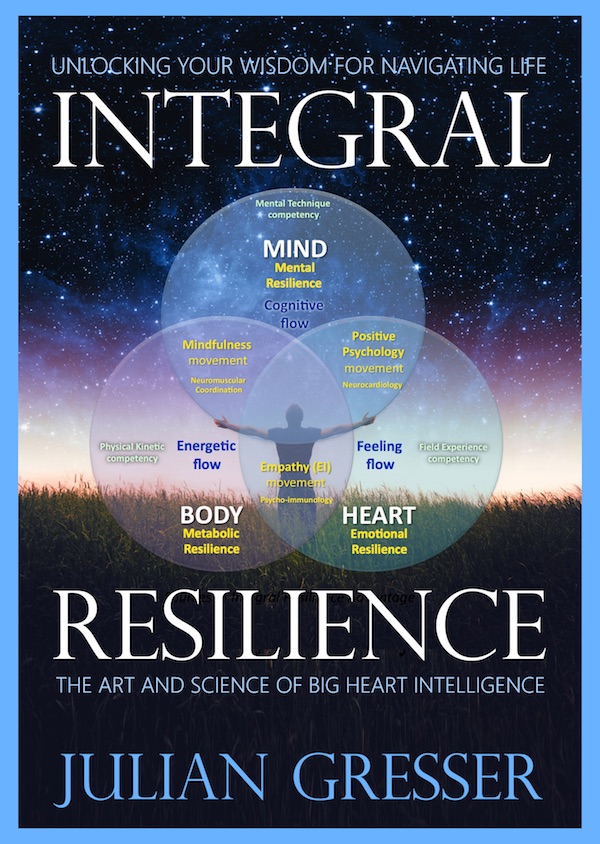

- 2015-2019 Big Heart Intelligence/Integral Resilience. In collaboration with his business partner of many years, JG is actively negotiating the widespread adoption through networks of strategic alliances of these new practices and methodologies that have broad humanitarian applications in science, medicine, technology, business, economics, and law.